Someone is sitting in the shade today because someone planted a tree a long time ago.

Warren Buffett

If you delay seeking financial advice your retirement may not be as carefree as you think. Wealth takes time to accumulate – the longer you delay, the higher the potential cost in the long run. Procrastinate about your finances and you may have to work for longer, cut back on travel or your plans to help your children financially.

Here are some of the reasons why:

Less money in the tax effective super system

Changes to super legislation caps the amount you can contribute in the years before retirement – which means less money in the super system being taxed at a maximum rate of 15 cents in the dollar.

The changes mean the amount you can contribute to super before-tax (includes salary sacrifice and employer contributions) has changed to $25,700 per annum for everyone (effective 1 July 2021). If your income (with some modifications) is greater than $250k, an additional 15% tax on concessional contributions is payable.

The cost of delay

There are two consequences for people approaching retirement:

1. More risk – if you are making super contributions above the new limits you may receive a nasty tax bill.

2. Tighter caps – the new rules mean you may not be able to cram money into super late in life – you may need to plan ahead and contribute over the longer term.

If stricter contribution limits affect you, now is the time to speak to an expert who can help you implement the tax and super strategy that suits you.

Less retirement income

Research shows people who do not receive ongoing financial advice may be almost $100,000 worse off when they retire.1 Inappropriate levels of investment risk, inadequate portfolio construction or simply a lack of investments outside cash deposits are three of the common reasons why.

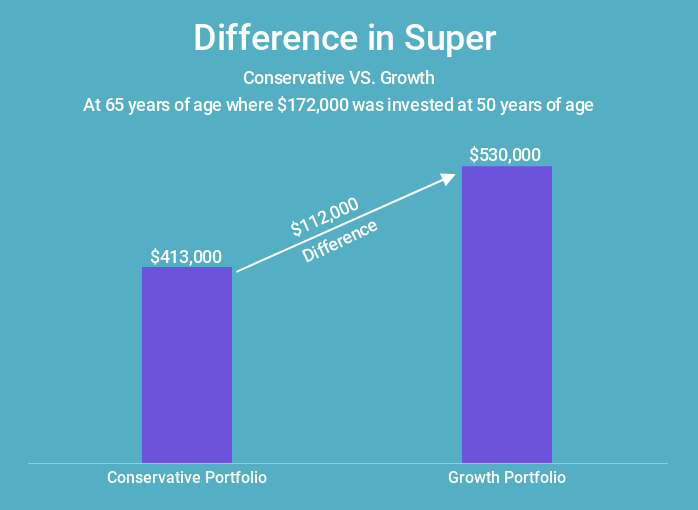

To illustrate this, consider a 50-year-old man with a super balance of $172,000 (the average balance according to research by the Association of Superannuation Funds of Australia).2 With approximately 15 years until retirement, the expected difference of investing in a conservative versus growth portfolio would account to approximately $112,000.* In this scenario, a conservative portfolio would have returned an expected 6.1% over 15 years for a balance of $418,000* and a growth portfolio would have returned an expected 7.8% for a balance over $530,000.*

*Calculated on average estimated Perpetual Private conservative profile returns and Perpetual Private balanced portfolio returns.

The cost of delay

The amount of risk you take (conservative versus growth) should be based on an assessment of your personal circumstances, which are likely to change over time. This is what makes ongoing financial advice crucial – for the advice to endure it needs to evolve as your life does.

Not having a structured investment portfolio in place can cost you – both in the accumulation of wealth and your level of retirement income. The example above demonstrates how much of a difference that can be.

Fast forward to your retirement and the risks of not having a sound financial plan in place are even higher. If you suffer a series of poor returns in the first few years of retirement, your investment portfolio may not have time to recover. Which means less retirement income.

Complications with your estate

Without an estate plan as part of your financial strategy, the legacy you’ve worked so hard to create may unravel once you’re gone.

Your superannuation and assets owned by trusts are unlikely to form part of your Will – other documents may be required to ensure these assets are distributed according to your wishes.

The cost of delay

If you fail to address these considerations as part of your estate plan, disputes or tax liabilities may arise, causing unnecessary delay and costs in the administration of your estate.

1 Financial Services Council (FSC), 'Better off with savings advice' research, February 2011. Perpetual Limited is a member of the FSC.