2020 was a year where we saw markets hit record highs – and endure record declines. The current market volatility might have you thinking about ‘playing a little more defence’ with your super. While a portfolio strategy that contains both growth and defensive assets is a good idea in any market condition, moving too far in either direction may mean you risk not reaching your retirement goals.

Ultimately, your investment decision isn’t a choice between growth or defensive – it’s how much of each you need. Striking the right balance comes down to understanding how much risk you’re comfortable with and balancing this against the risk you need to take to reach your retirement goals.

That’s why factoring in your appetite for risk – your risk profile – is a vital component in building your super portfolio. Before you make an investment decision, ask yourself:

- What is my desire to take risk?

- What is my financial capacity to take risk?

- What is my need to take risk?

Whilst these high-level questions consider your emotional response to risk and your financial ability to invest, they all have one important element in common – your investment time horizon. By matching the time horizon of your goals with that of your asset allocation strategy, you’re maximising your chances for success.

With a clear risk profile, you can build an appropriately diversified portfolio with the right mix of asset classes, each with their own different risk – and reward – characteristics, to reach your investment goals.

At Perpetual Private, we define growth assets as investments with equity characteristics, where capital growth is a significant driver of returns, these include Australian shares, international shares and real assets. On the other hand, defensive assets are relatively capital stable, with income being the predominant source of return, such as cash and fixed interest investments.

The closer you are to retirement, conventional wisdom suggests that you should transition money into more defensive assets such as cash and fixed income.

In the current environment, however, record low interest rates mean cash is going backwards in real terms. On the other hand, equities typically deliver returns that outstrip inflation, but without any certainty through your retirement. Finding the right balance is tricky and a disciplined approach to asset allocation for your super is more important now than ever.

Effective asset allocation takes on enough risk to grow your investments, but not so much that you are uneasy or nervous and sell at exactly the wrong time. After all, you won’t get the full benefit of your long-term investment strategy if you can’t stay invested during challenging times.

Managing risk by understanding your risk profile

Moving into and out of investments in response to prevailing market conditions is time consuming, expensive and will almost certainly leave you worse off. A more effective, long-term way to manage how your money is distributed between various asset classes, is to use your risk profile.

Based on your risk profile, you and your financial adviser can easily align your investments to a suitable asset allocation strategy. Below are the main asset allocation strategies used by Perpetual. Whilst the strategy names in this table are used industry-wide, they can mean different things to different advisers or investment managers. The characteristics used to describe the strategies are based on Perpetual’s view.

|

Strategy |

Characteristics |

|

Conservative |

Conservative portfolios prioritise income-generating, lower risk assets for investors who have a low risk appetite or short-term investors who may need to withdraw money soon. The returns of this risk profile are highly dependent on interest rates and their movements. Perpetual’s Conservative portfolios has 60% in defensive investments and 40% in growth investments. |

|

Diversified |

Diversified portfolios seek a blend of investments across multiple asset classes for the purpose of generating income, together with modest capital growth that outstrips inflation. They may be suitable for risk averse long-term investors or those in retirement who are drawing down on their money to meet their income needs. Perpetual’s Diversified portfolios has 40% in defensive investments and 60% in growth investments. |

|

Balanced |

Balanced portfolios seek a blend of investments across multiple asset classes for the purpose of generating income, together with capital growth that outstrips inflation. They may be suited to long-term investors who want to protect their wealth and accept some volatility to achieve growth. Favoured by retirees or those nearing retirement. Perpetual’s Balanced portfolios has 28% in defensive investments and 72% in growth investments. |

|

Growth |

Growth portfolios are biased towards investments with a high prospect of capital appreciation, with a lower level of income generated. Growth funds have higher risk than average and are suited to investors with a longer investment time horizon. Perpetual’s Growth portfolios has 85% in growth investments and 15% in defensive investments. |

|

High growth |

These funds are for long-term investors with a high risk tolerance and little need to withdraw from their portfolio. Expect significant share market volatility. The returns of this risk profile are highly dependent on the performance of the stock market. Perpetual’s High-Growth portfolios has 98% in growth and 2% in defensive investments. |

The differing definitions of these funds and their underlying asset allocation can make a significant difference in investment risk vs returns. Let’s look at an asset allocation strategy common in the early years of retirement – the ‘Balanced’ fund.

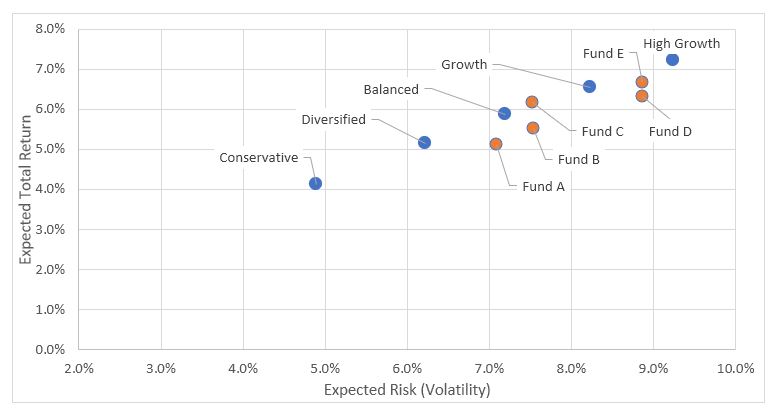

The graph below shows expected risk versus return characteristics of the ‘Balanced’ investment option for five industry superannuation funds (red dots) when compared to Perpetual Private’s core risk profiles (blue dots). For each portfolio, the figures shown are calculated using risk and return estimates for the underlying asset classes, then aggregated to a total portfolio level using the asset allocation.

The chart illustrates how Perpetual Private constructs portfolios; seeking to maximise returns for a given level of risk. When comparing two portfolios, the more optimised portfolio will either have a higher return (upwards on the y-axis) or a lower risk (to the left on the x-axis). You may notice that the Perpetual portfolio follow a curve-like trend; this is referred to as the “efficient frontier”, which represents the maximal return available for the amount of risk taken.

The chart also demonstrates how different superannuation providers use different labels for their various asset allocation strategies; Funds A through E are all labelled as a “Balanced” option but have widely varied levels of risk. This is an important consideration when comparing returns from superannuation fund providers as you are not comparing ‘apples with apples’ as the underlying asset allocation, and therefore the inherent risk, may be meaningfully different.

Efficiency tool: Perpetual Private Investment Research team. Industry superannuation fund asset allocations sourced from Xplan/IRESS and are subject to change. Expected risk and return figures are calculated from the asset allocation for each portfolio and risk/return estimates for each underlying asset class. The individual asset class assumptions are projections based on a combination of historical and forward-looking data, such as bond and dividend yield, earnings growth trends and valuation considerations.

Efficiency tool: Perpetual Private Investment Research team. Industry superannuation fund asset allocations sourced from Xplan/IRESS and are subject to change. Expected risk and return figures are calculated from the asset allocation for each portfolio and risk/return estimates for each underlying asset class. The individual asset class assumptions are projections based on a combination of historical and forward-looking data, such as bond and dividend yield, earnings growth trends and valuation considerations.This is also why you should take a look under-the-hood of your super, making sure your managed fund investments match the characteristics you’re expecting.

There’s a lot to consider when deciding what super structure and investments are right for you. At Perpetual, we believe a broad and well-diversified exposure across different asset classes is always a good approach to constructing your investment portfolio.

Beyond that, finding – and adjusting – the right mix of managed funds and individual investments that will help you reach your retirement goals can be complex.

The first step is to understand the level of risk you’re comfortable with. This will help you manage your emotions, stay invested and make you a better investor.

Talk to your financial adviser to determine your investment risk tolerance and make sure your investments decisions are aligned to your retirement goals, and within your risk profile.