In what’s been an unsettling start to 2020 (coronavirus, Australian bushfires, tradewars and other geopolitical risks) we’re seeing a growing number of enquiries from clients about how to protect what they care about most – including their family and home. In this article, we explore how the family and the family home act as key drivers for making financial decisions in times of uncertainty. We also provide some practical tips on how you can protect your loved ones and ensure you safeguard your assets and financial wellbeing.

What do Australians care about?

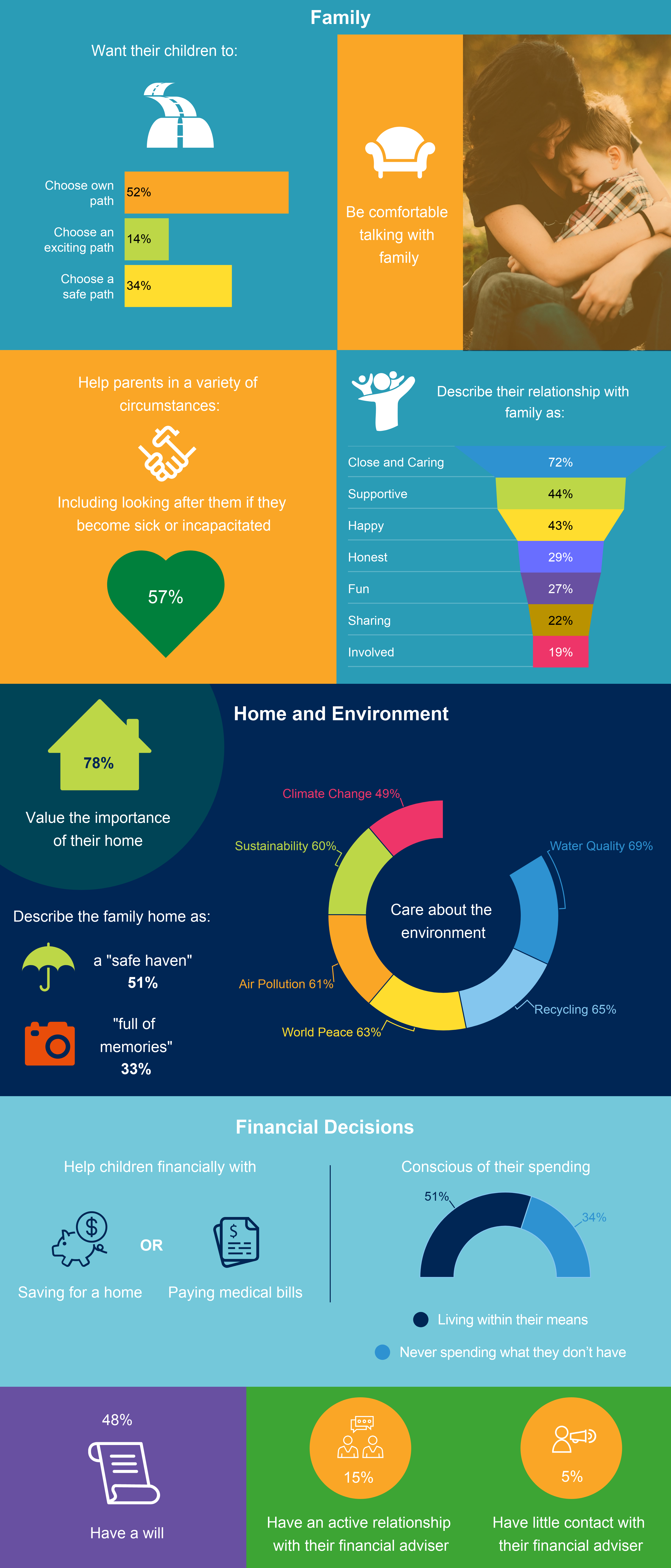

When we asked 3,000 Australians about their key priorities in life, family (88%) is the area that resonated most, followed by one’s financial situation (69%) and physical health (69%). The differences between men and women are subtle, with women giving family a slighter higher weighting than men (91% vs 84%).*

Key findings from Perpetual ‘what do people care about’ study

There were some interesting findings for those Australians who care most (as opposed to those that care a little) about family. For example, Australians who care more than anything about family are more likely to:

Source: Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019

Source: Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019

How do Australians approach financial decisions?

Based on the research, it’s clear that family is a key priority for many Australians; protecting the home and ensuring financial security is a key component of financial decision-making.*

Gary Lembit, Senior Manager of Client Insights and Analytics at Perpetual suggests: “the more you care about your family, the more willing you are to contribute financially in order to protect them and everything you’ve worked so hard to achieve. We’re seeing this translate to a deeper relationship with a financial adviser and a higher level of engagement on things like the will, a home loan or an investment portfolio.”

He adds: “Family and the need to protect family is at the core of what drives financial behaviour. Family protectors are conscious of their spending; they’re not splashing their money around. They’re generally more careful with their money and will seek to live within their means”.

The study also showed that the more someone cared about their family, the more they cared about the environment and things like sustainability and climate change. This points to a link between being family-oriented and having a greater sense of economic and social-responsibility.

“As much as these Australians whose priority is protecting their family are willing to help their family financially, they are also far more likely than other Australians to want their children to choose their own path in life and be financially independent.,” asserts Lembit.

Ensure you protect what you care about

To protect your family and the wealth you’ve spent a lifetime building up, we suggest you:

Involve your adviser

Discuss and regularly review your priorities and goals with a financial adviser. A core element of a financial plan is to cover the costs of ageing by protecting your nest egg for the long term. Estate planning and the transfer of wealth are also carefully considered.

According to Lembit: “People with a financial adviser are planning for their future. They recognise the value of expertise and they’re keen to be financially independent in retirement. They’d like to fulfil their personal goals while assuring the future for their family.”

“Your financial plan should change as your life changes. This means regularly reviewing your plan to make sure it continues to be relevant to your needs.”

Involve your family

Have a (sometimes difficult) conversation with your partner and/or children about your financial plan. Talk openly about your goals, the will and any intentions to leave a legacy.

“A time of crisis or uncertainty, like we’re experiencing now, may trigger these types of discussions. But we shouldn’t let circumstances force the conversation. It’s important your loved ones understand your intentions and you work together to agree on the role you would like them to play in safeguarding your legacy,” notes Lembit.

Lembit, G., (2019) ‘What do you care about’, Perpetual Client Insights and Analytics, released 26 September 2019