If there’s one thing that sets an exceptional executive apart from their peers, it’s focus – the ability to drive a business towards its strategic goals without getting distracted by short-term setbacks, corporate politics, market ‘noise’ or personal issues.

Paradoxically, that almost obsessive focus can damage an executive when it comes to building their own wealth and guaranteeing financial security for their families. The tunnel vision intrinsic to their corporate success can stop them taking advantage of the single most important wealth-building tool available to them – maximising the opportunity within their Executive Share Scheme (ESS).

“For the executives we work with – C-suite executives and those on that track – executive share schemes are the primary driver of wealth,” says Perpetual Private Senior Adviser, Shiva Vemula. “For these few really senior business leaders, optimising their executive share schemes and the structures in which they are held over the length of their career is what determines their lifetime balance sheet.

When structured correctly, it also means the capital they’ve built up can flow more seamlessly to the generations to follow.”

Be invested – but not over-invested

According to fellow Perpetual Private Senior Adviser, Daniel Swallow, executives’ terrific focus on their corporate role can limit their financial success if these time-poor executives don’t invest time in getting the most out of their ESS. “An ESS will only be transformative if it’s well managed. The lack of strategy can lead to suboptimal after-tax outcomes with increased risk,” says Daniel.

For top-quality executives, success comes from living and breathing the company they lead. Driven by the positive mindset common to top leaders, they believe their business will succeed and that its success will make them wealthy.

“It’s an understandable, even admirable approach,” says Shiva, “but no matter how hard you drive a business, there are factors that can bring it undone that you have no control over (pandemic lockdowns anyone?). If that happens – and if most of your wealth is tied to a share scheme where the underlying security is underperforming – your wealth is at risk. So all your hard work goes unrewarded.”

Three-factor success

According to the advice team at Perpetual Private, there are three factors executives need to manage around their ESS.

1. Risk and diversification

One of the biggest issues for executives is concentration risk. Their employer pays their salary, pays their super and grants them shares or options based on success.

“It’s a bit of a poisoned chalice,” says Perpetual Private’s Daniel Swallow. “If all goes well, there’s the chance to build wealth that secures your family’s future. But if it doesn’t, you’re overexposed to one asset with potentially high capital gains liability in a less-desirable tax structure.”

The key is for executives to see their ESS as just one part of their portfolio – and to diversify the rest of their wealth to offset their exposure to their employer’s shares (see the case study below). “With C-suite executives, we’re hyper-focused on risk and diversification. This is not just a case of having a broad portfolio outside their company shares. It might drive us to focus on shares that are lowly correlated to the ones in the share scheme. Or to push a significant amount of a client’s capital into a completely different asset class. Our approach will take into account the structure of the ESS and what are the primary drivers of the specific company’s performance.”

Client testimonial: John, CFO, Financial services (software)

“Daniel and Shiva have developed and executed an ongoing tailored strategy to enhance my family’s wealth, with a particular focus on maximising the Executive Share Scheme I have in my role as a CFO.

From the very beginning, ensuring the most appropriate structures from an asset protection and tax efficiency perspective was always front of mind. This included how best to utilise the shares that vest in each period, including which entity would be most suitable to hold these after seeking board approval. Consideration was always given for our longer-term objectives and other notable considerations including tax payments, superannuation, expenditure and diversification of assets.

I would strongly recommend any senior executive liaise with Daniel and Shiva to ensure they too benefit from their services tailored for people in our role.”

*The text of this testimonial was provided by the client. His name has been altered to ensure confidentiality.

Case study: The CFO and the matrix

Daniel Swallow and Shiva Vemula work with many C-Suite executives. One was a CFO of an ASX-listed company.

Working within strict guidelines and in association with the board and company secretary, they helped him transition ESS shares into his SMSF and to other tax effective structures without affecting the company share price.

“It was a good strategic move,” says Shiva, “because his long-term wealth remains aligned with his company performance but he now reaps the benefits of a tax-effective structure optimised for longer term wealth creation and asset protection. The tax minimisation alone can have a magnified effect on wealth creation over time.”

Daniel then helps manage the client’s concentration risk by building a ‘correlation matrix’ to ensure assets used as a diversifier are in shares or market sectors with low correlation to those linked to the executive’s salary or ESS. “Whilst we cannot control the share price of the ESS scheme, we can carefully tailor external portfolios to mitigate a connection between the client’s wealth strategy and company performance.”

“Senior executives with an ESS don’t really have the luxury of a set-and-forget strategy,” says Shiva. “There are a lot of moving parts and considerations – eligibility for tax-deferrals or CGT discounts, vesting schedules (time vs performance), blackout periods, contribution caps and strategies that manage longer term risk. Specialised, tailored advice can make a major difference as each executive’s situation is different – and so are the ESS requirements and restrictions.”

2. Tax thinking

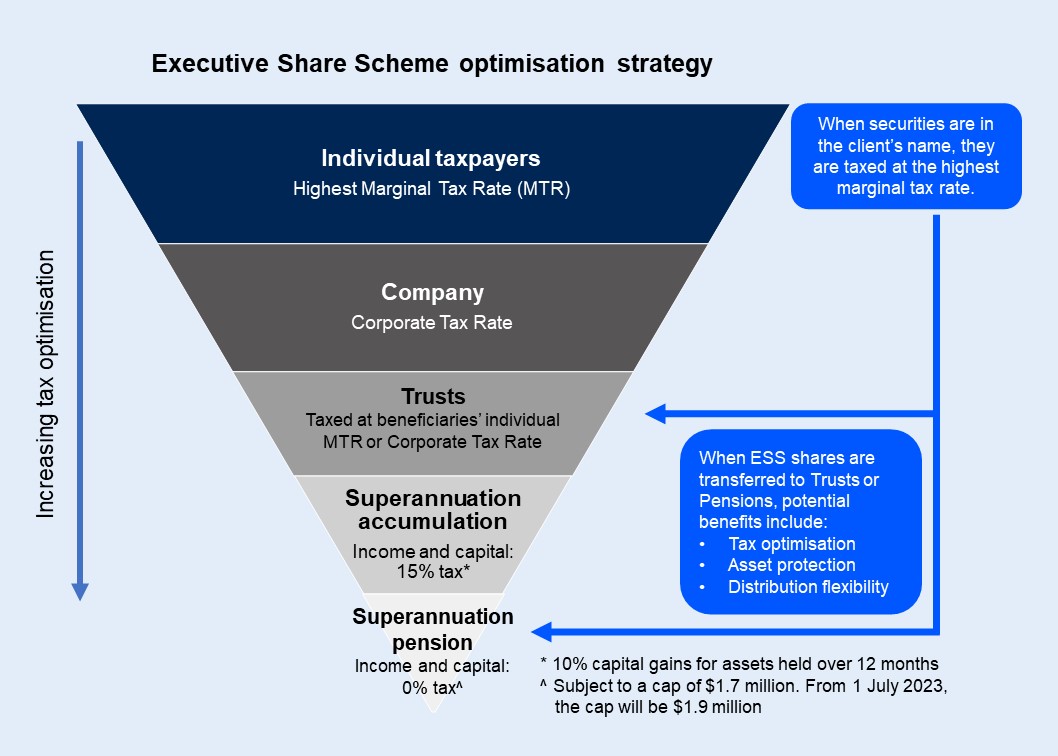

Making the most of your ESS means paying the tax you should pay and no more. For executives, that means getting the ESS shares into the right tax structure.

A Self-Managed Super Fund (SMSF) or trust structure may allow the flexibility for an executive to get all the benefits of their share scheme, with returns taxed less heavily. “We often work with the board or HR team to structure an ESS so the shares can be held in a more tax-efficient environment,” says Shiva Vemula.

“Obviously, the company wants to make sure they’re acting in accordance with tax regulations and that the scheme incentivises their executive. It’s our job to devise an approach that does both those things and generates the best after-tax result for our client over the long term.”

The other key tax consideration is about timing. Each ESS is different. Some use on-market shares. Others use share options. The vesting timelines and performance hurdles are always unique to each company. “When we’re thinking about tax efficiency for an executive client, we’re always aware of the specific conditions of their scheme, what tax events they create and how to manage that optimally for the client with alternative strategies. That means taking a broad view. For example, offsetting any ESS share vesting or sales against capital-loss selling in the client’s broader portfolio.”

Given the specialised and highly tailored nature of the schemes, it is imperative to receive advice as early as possible. This is where Shiva and Daniel work with their in-house tax specialists and their client’s accountants to ensure the optimal structures are established and carefully managed over time.

3. Asset protection and wealth transfer

Intelligent structuring provides other major benefits for executives and company directors. One is the additional layer of protection provided by holding assets in a separate entity such as an SMSF or Family Trust. Generally speaking, these assets are much more difficult to access by creditors if executives are sued (e.g., for breach of director duties) or are in financial difficulties (bankruptcy).

Successional planning and intergenerational wealth transfer are equally important objectives that can be achieved with strategic structuring. The wealth amassed through an ESS can be ‘foundational’ – serving the family and future generations. Ensuring that this capital can flow to future generations in a seamless, friction-free manner is crucial.

Source: Perpetual Private. April 2023. For illustrative purposes only. This is general information only and is not intended to provide you with financial advice or take into account your objectives, financial situation or needs. You should consider, with a financial or other adviser, whether the information is suitable for your circumstances. The tax information contained in this document is not tax advice and should not be relied on as such.

Exit strategy

An exit strategy is the final piece of the ESS puzzle and a place where personalised advice may be vital because the strategies required are so bespoke. An executive might have to manage the reality that their ESS shares are underperforming. Or they might have to sell out in tranches due to tax considerations, scheme rules, liquidity or because of the reputational risk to their firm if a senior executive sells all their shares.

“It’s quite likely that an executive exiting their share scheme has a lot going on in the rest of their life,” says Shiva Vemula. “Whether they’ve been headhunted for another role, resigned or retired, one of our roles is being the ‘clear head’ when it comes to the most important decision of all – what to do with the ESS funds once you have it in your hands.”

What to do now?

If you’re an executive who thinks a more strategic approach to their ESS could help secure their financial future, fill in the form below and one of our specialist advisers will be in touch.