Global investor Barrow Hanley believes emerging markets represent compelling value as they trade at multi-year lows versus developed markets. Here’s why now could be a turning point

- Emerging markets out of favour compared to strong, developed markets

- Signs of improvements in Chinese corporate sales, margins and earnings

- A rising commodity cycle and weaker USD outlook could be good for EM

- Find out about Barrow Hanley Emerging Markets Fund

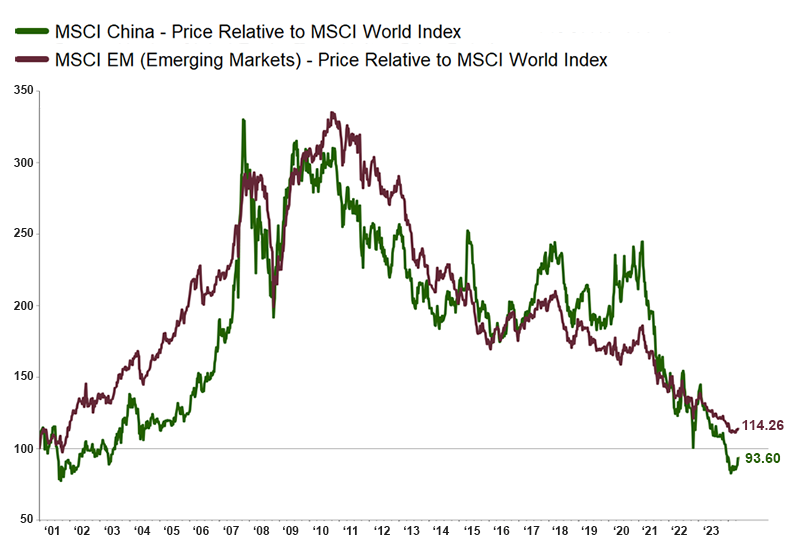

Since their peak in 2010, emerging markets have seen a prolonged period of underperformance relative to their developed-market peers.

This trend, seen in the chart below, has understandably prompted some investors to question the effectiveness of an allocation to emerging markets.

But it’s worth considering what drove EM performance in the decade leading up to 2010 – and whether these conditions could return.

Chart 1: Prices relative to MSCI World Index. Source: FactSet

What drove emerging markets in the 2000s?

From the end of 2000 until that peak at the end of 2010, emerging markets experienced a meaningful period of excess performance over their developed market peers.

Key drivers over that period include:

- a strong commodity cycle

- a weakening US dollar

- strong performance from Chinese equities.

If you look at China’s performance relative to the MSCI World Index, it largely mirrors the path of emerging markets.

That’s not unexpected given China’s large weight in the index, including very strong performance leading up to the latter part of 2010 and a prolonged reversal of fortune since.

In February, China touched lows similar to the early 2000s.

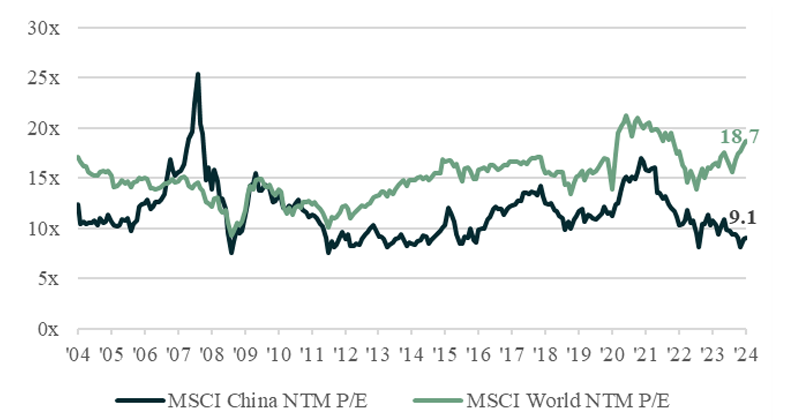

It’s now trading at valuation levels last seen in the early 2000s (see Chart 2 below), which is pushing the emerging market index to multi-decade valuation lows.

This raises an important question for investors:

Do valuation discounts warrant an allocation to emerging markets – and potentially even an overweight to China within that allocation?

We believe the answer is yes, given what we’re seeing not only in the underlying markets but also the underlying fundamentals of companies that Barrow Hanley owns.

Chart 2: MSCI China and MSCI World NTM (next 12 months) P/E ratios 2004-2024. Source: FactSet

Markets don’t repeat, but they do rhyme

We believe there is a set-up in the markets similar to what we saw in the early 2000s in which the US dollar was strong, commodities (gold, silver, copper, etc) were undervalued and beginning to improve, and China was poised to perform strongly.

We appreciate that markets do not repeat themselves – but they do rhyme.

We’re now seeing some of these trends reversing, meaning commodities are firming and China growth is not imploding and appears to have bottomed.

The last item would be a weakening of the US dollar.

This could be a welcome outcome through the current administration or a policy to support US competitiveness in global markets.

We are beginning to see improvements in sales, margins and earnings among the companies that we own in China.

Along with cheap valuations, we see these improvements as a strong catalyst for relative performance going forward.

We also believe these companies will benefit from Chinese government efforts to broaden the drivers of growth outside the property market – though they have reversed course and are beginning to provide stimulus to this part of the market.

Instead of simply broadening its industrial capacity, China has been attempting to move to a more consumption-oriented economy on top of a more innovative economy.

Once achieved, this should help reverse course for the broader China market – and thus emerging markets – helping pull them out of a long-term downward trend.

Why allocate to EM value now?

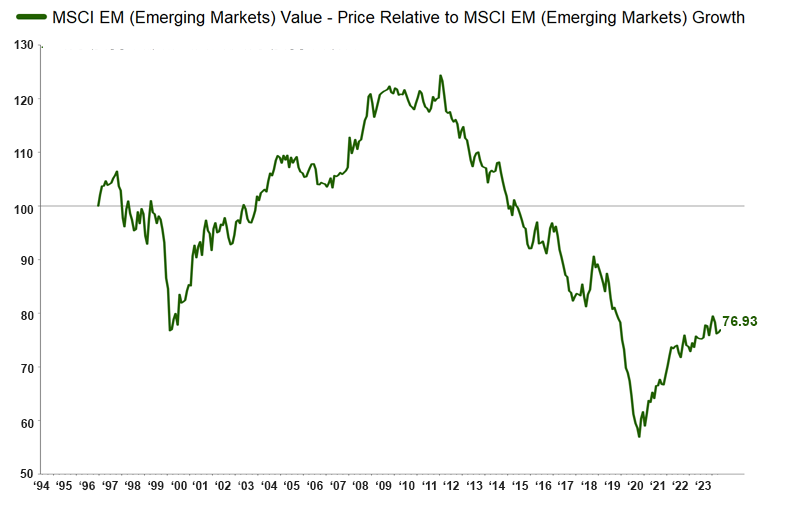

We have seen a prolonged period of “growth” outperformance in emerging markets since 2010.

Much of this has been in tandem with growth outperformance in developed markets.

However, over the long term, value investing has been a winning strategy in emerging markets.

If we look at the MSCI Emerging Market Value and growth indexes since 1996, we can see EM growth stocks behaved similarly to US growth stocks in the late 1990s, outpacing their value peers.

Value stocks posted very strong results in the value run of the early 2000s through to 2011 until lower inflation and lower interest rates drove growth stocks to outsized returns.

That continued until inflation began to push higher in late 2020, where value stocks began to take the lead.

You can see this in Chart 3 below.

Chart 3: MSCI Emerging Markets Value Index 1994-2024. Source: FactSet

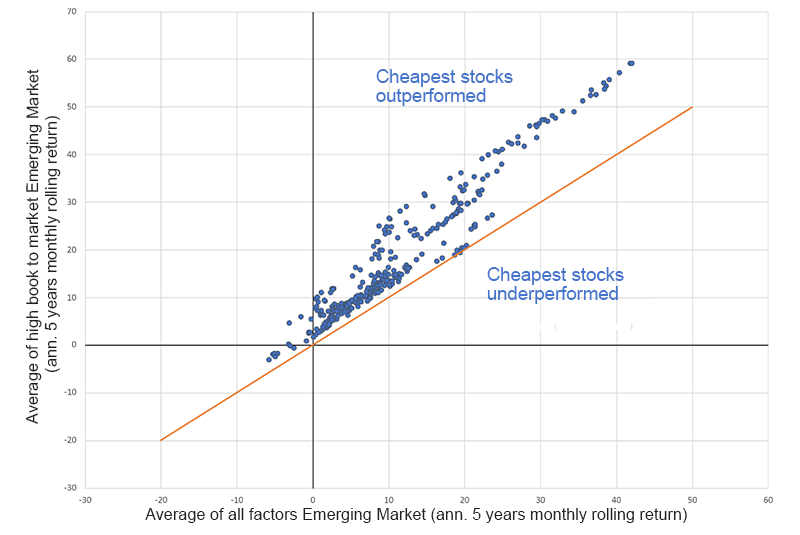

From a factor perspective, another way to view the benefits of investing in emerging market value stocks is by looking at the Fama and French Three-Factor Model framework.

The Fama French Model is an investment theory that expands on the Capital Asset Pricing Model by adding two factors – size and value – to better explain stock returns.

As shown in Chart 4 below, since the end of 1996, stocks trading at high Book-to-market multiples (ie value stocks) tend to outperform over the longer term rather consistently.

Chart 4: Average high book-to-market vs average "all factors" (USD) 1996-2024. Source: Kenneth R. French Library Database

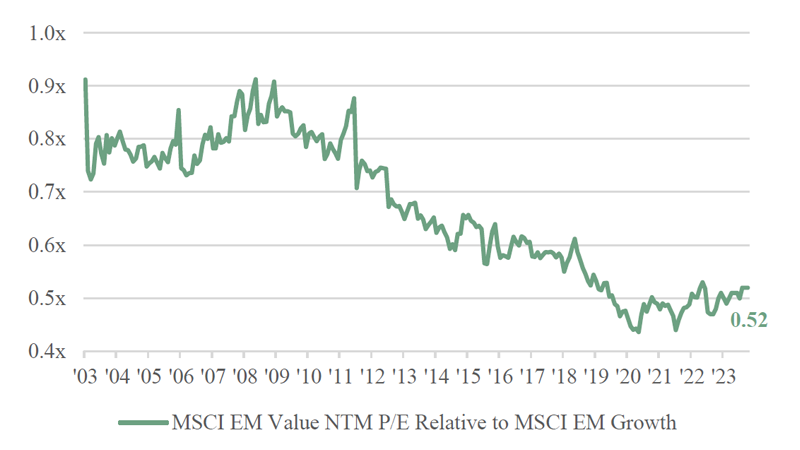

If we look at the valuation spread between emerging market value stocks relative to emerging market growth stocks on a NTM (next 12 months) P/E basis, despite the recent run in value stocks, a large valuation dispersion remains between growth and value stocks.

There is meaningful room for reversion to higher multiples for value stocks, which should ultimately push value stocks’ performance higher relative to growth peers.

See Chart 5 below.

Chart 5: MSCI Emerging Markets “Value” index NTM (next 12 months) P/E relative to MSCI EM “Growth” Source: FactSet

We don’t believe reversion or cheap valuations alone are sufficient catalysts to see a re-rating in value stocks.

But we do believe that improving fundamentals that produce margin growth, sales growth, multiple expansion, or greater capital efficiency will unlock suppressed value.

We strive for a combination of these fundamentals when looking for individual companies to invest in.

Green shoot in emerging markets

Despite a prolonged period of underperformance, we are beginning to see green shoots in emerging markets that lead us to believe we could be in a bottoming phase with great potential for strong future performance.

We’re very excited about our portfolio and how it is positioned.

Given that our portfolio is trading at a meaningful discount to emerging markets generally, we believe this positions us well for a re-rating higher.

About Barrow Hanley’s emerging markets investment strategy

The Barrow Hanley Emerging Markets Fund aims to provide long-term capital growth through investment in emerging market shares and to outperform the MSCI Emerging Markets Net Total Return Index (AUD) (before fees and taxes) over a full market cycle, typically five years.

The team strives to achieve the fund’s objectives by adopting a value-oriented, bottom-up investment process focused on in-depth fundamental research.

Barrow Hanley seeks to identify companies that trade below their intrinsic value for reasons they can identify, believe are temporary and have a clearly identified path to achieving fair value.

Find out more at the Barrow Hanley Emerging Markets Fund web page.