The Trust Company Philanthropy Fund

Updates

Product disclosures

The Trust Company Investment Funds have been terminated and the PDS is no longer available.

The PDS summarises information about The Trust Company Philanthropy Fund (Fund).

The additional information document contains further information including fees, fund operations, tax and general information.

PDS Notice of election for early transition to new fees and costs disclosure

Continuous disclosures and important information

Date |

Summary of event |

Impact |

|---|---|---|

18 October 2024 |

Fund Termination and PDS withdrawal |

The Trust Company Philanthropy Fund is terminated effective 18 October 2024. The Product Disclosure Statement (PDS) for The Trust Company Philanthropy Fund has been withdrawn effective 18 October 2024. Please read the letter to investors regarding these changes for additional information or contact us on 1800 022 033. |

9 May 2024 |

Correction to performance returns | Performance returns for The Trust Company Philanthropy Fund posted on our website between 8 February 2024 to 8 March 2024 did not accurately reflect the performance returns for the dates provided. This has been rectified and the correct performance returns have been displayed on our website from 9 March 2024. See attached flyer. |

1 March 2024 |

PDS Update: Fees and Costs Information | The information in the PDS and Additional Information about fees and costs is replaced by the information in the attached PDS update. An Investor Letter is also available. For full details on fees and costs, read the PDS together with the PDS update. |

9 October 2023 |

PDS Update: Fees and Costs information | The information in the PDS and Additional Information about fees and costs is replaced by the information in the attached document. For full details on fees and costs, read the PDS together with this update. |

1 October 2022 |

PDS Update: Fees and Costs information | The information in the PDS and Additional Information about fees and costs is replaced by the information in the attached document. For full details on fees and costs, read the PDS together with this update. |

1 June 2022 |

Changes to normal operating expenses |

We have introduced a fixed amount of 0.01% per annum for normal operating expenses charged to the respective Fund

|

17 September 2021 |

Updated disclosure regarding distribution payments |

Updates to disclosure to clarify that distribution components may include capital.

|

18 June 2021 |

Notice of Pricing Delays |

Delay of unit pricing for a number of Funds and Investment Options.. For further information see attached flyer

|

1 April 2021 |

Changes to Buy/Sell Spreads |

Effective 1 April 2021, the buy/sell spreads for the funds have changed. Please see “Transaction costs and Buy/Sell Spreads document.” |

10 July 2020 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 10 July 2020 information now available. For further information see attached flyer. |

29 May 2020 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 29 May 2020 information now available. For further information see attached flyer. |

24 April 2020 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 24 April 2020 information now available. For further information see attached flyer. |

27 March 2020 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 27 March 2020 information now available. For further information see attached flyer. |

20 March 2020 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 20 March 2020 information now available. For further information see attached flyer. |

1 October 2018 |

PDS Update: Transaction Cost & Buy/Sell spread document updated |

This incorporated document has now been replaced with 30 June 2018 information now available. For further information see attached flyer. |

11 September 2018 |

Change to external dispute resolution (EDR) scheme |

From 1 November 2018, there will be a change to the EDR scheme which unresolved complaints can be referred to. Please refer to this transitional disclosure for more information. |

9 July 2018 |

Reduction of buy/sell spread |

Effective from 9 July 2018, the buy/sell spread of the Fund will be reduce as follows: Current buy/sell spread (%): 0.175/0.175 New buy/sell spread (%): 0.12/0.12 Find out more here |

1 June 2018 |

PDS Update |

The replacement The Trust Company Philanthropy PDS has been issued. It contains updated information in relation to the Product Update notice on 21 May 2018. For a copy of the replacement PDS click above, or ask for a copy free of charge by contacting us on 1800 022 033. |

21 May 2018 |

Change to Fixed Income & Real Estate Benchmarks |

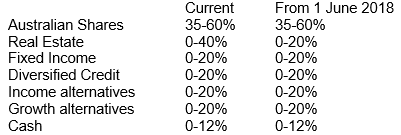

Following a strategic asset allocation review, the following changes will take effect from 1 June 2018: Fixed Income benchmark will change from: 50% Bloomberg AusBond Composite 0+Yr Index and 50% Bloomberg Barclays Global Aggregate Index (hedged to AUD) to Bloomberg AusBond Composite 0+ Yr Index Real Estate benchmark will change from: Asset weighted composite of the S&P/ASX 300 A-REIT Total Return Index (listed Property securities) and Mercer/IPD Australian Pooled Property Fund Index (unlisted property securities) to S&P/ASX 200 A-REIT - Total Return Index Investment Guidelines will change from:

|

1 November 2017 |

Change to Fixed Income Benchmarks |

Following a strategic asset allocation review the following changes will take effect from 1 November 2017: Fixed Income benchmark will change from: 50% Bloomberg AusBond Composite 0+Yr Index and 50% Barclays Capital Global Aggregate Index (hedged to AUD) to 50% Bloomberg AusBond Composite 0+Yr Index and 50% Bloomberg Barclays Global Aggregate Index (hedged to AUD). |

29 September 2017 |

AMIT Regime |

Perpetual has elected into the Attribution Managed Investment Trust (AMIT) Regime for the year ending 30 June 2018 and subsequent years. |

22 June 2017 |

Changes to the constitution of the Fund/s |

Perpetual has made changes to the constitutions for our Funds to allow them to be operated as Attribution Managed Investment Trusts. These changes will apply only from the time an election is made by Perpetual to adopt the AMIT regime for the relevant Fund. We will provide notification on the website if/when this election occurs. |

26 May 2017 |

Proposed Changes to the constitution of the Fund/s |

Perpetual is proposing making changes to the constitutions for our Funds to allow them to be operated as Attribution Managed Investment Trusts (AMIT) Find out more here |

1 March 2017 |

New Product Disclosure Statement Dated 1 March 2017 |

Effective 1 March 2017, we have updated fees and costs information, and issued a new PDS. Due to changes in ASIC Class Order [CO 14/1252], we have updated our disclosure in respect of the estimated management cost of the Fund. This amount includes estimated indirect costs which are paid by the Fund, and are not a direct cost to you. The management fee you pay to Perpetual has not changed. For a copy of the replacement PDS click above, or ask for a copy free of charge by contacting us on 1800 022 033. |