PRIVATE credit has morphed from a cottage business mostly focused on distressed debt into a massive global business over the past decade.

And as Michael Murphy, Portfolio Manager for the Perpetual Loan Fund, explains, allocation to actively managed, risk-aware domestic private credit has an increasingly important role to play in a diversified portfolio.

In an environment of tightening financial conditions, stretched equity valuations and elevated bond market volatility, investors face a challenge in identifying assets offering an adequate premium above cash for their level of risk.

We believe that allocation to actively managed, risk-aware domestic private credit has an important role to play in a diversified portfolio.

With central banks hiking base rates and credit spreads widening over 2022, returns on private credit are finally living up to the name ‘high yield’. Private loans are offering attractive yields compared to equities, with the Credit Suisse US First Lien Loan Index currently offering a yield to maturity of 9.3% vs the S&P 500 providing an earnings yield of 4.6%.

With the Fed funds rate currently at 5% to 5.25% and the RBA not far behind at 4.1%, investing in ‘risk free’ options such as government bonds or bank deposits are also attractive relative to equities at present.

So, the next question is, does private credit provide a great enough spread (i.e. return premium over ‘risk free’ investments) to compensate for the risk?

Much has been made of the wave of defaults of uneconomic ‘zombie’ firms after the end of pandemic-era government support and cheap debt, however, we believe that the current spreads offered provide attractive compensation for the risk.

In our view, the current market pricing embodies excessive pessimism, which provides the opportunity to surprise on the upside.

The spread on loans provides compensation to investors for both the limited liquidity and the risk of losses if a loan defaults (credit risk).

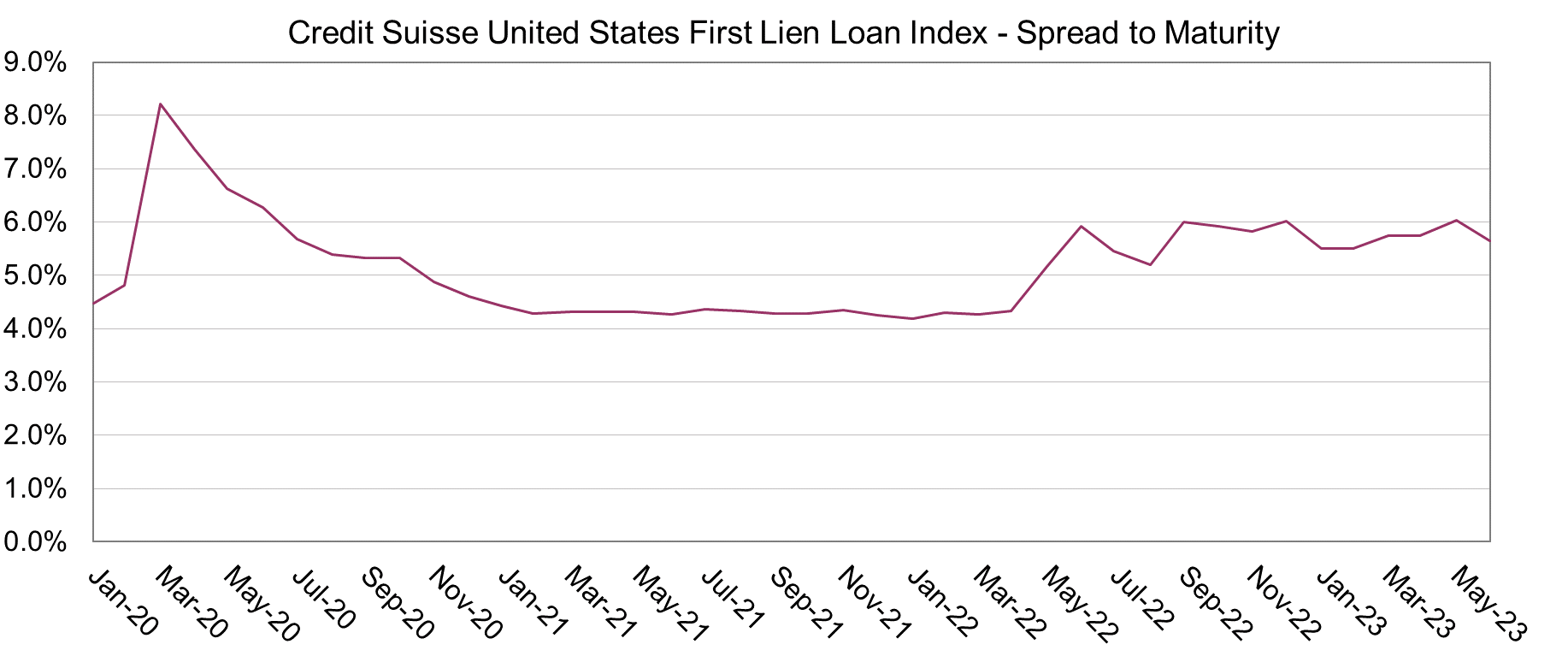

While spreads have retraced compared to the wides observed in early 2020 (Covid) and mid-2022, they are still at attractive levels with the CS US First Lien Loan Index currently at a spread of 5.5%.

Source: Credit Suisse, as at 30/06/23

We believe the Australian private credit market offers even more attractive risk-adjusted returns compared to the US market, with less intense lender competition.

This is because regulatory changes have seen domestic banks pulling back from lending in this space, domestic non-bank lenders in the early stages of growth, and offshore lenders only just starting to enter the market in a meaningful way.

In addition, the less intense lender competition in Australia has meant the lender protections have generally remained stronger, improving the expected recoveries on distressed credits.

We have been through a benign period with historically low default rates, and this has rewarded market participants who have indiscriminately taken on more risk.

We expect the current challenging macroeconomic environment to lead to increasing default rates, which will reward managers that have focused on asset quality.

Private credit, particularly in Australia, has a relatively low level of liquidity, which can make it challenging to quickly adjust the portfolio to reflect changing economic conditions.

The Perpetual method is to prepare for tightening financial conditions by maintaining strict investment discipline and a focus on quality even during periods of market exuberance, such as in 2021.

During this period, we saw many borrowers coming to market with a relatively weak business profile (which would struggle to raise debt in the current market) and lenders also being willing to provide too much debt to borrowers predicated on the expectation of persistent near zero interest rates.

We remained very selective in 2021, rejecting almost all deals, and only investing with issuers that aligned with our strategy of focusing on large corporates with significant market shares, economic moats, and recurring revenues that are resilient to economic downturns.

A key advantage of Perpetual’s funds that invest in private credit is that they are diversified across multiple credit asset classes, so when the private credit market is running hot - like it was in 2021 - we are not under any pressure to commit to new deals.

We believe private credit is currently offering attractive yields for the level of risk and that an actively managed, quality-focused allocation to private debt has a role to play in a balanced portfolio.

The yields on offer are competitive relative to equities, traditional fixed income and cash type investments, offering attractive compensation for the risk of higher credit impairments in the near term.

We see the Australian private credit market as offering more attractive risk adjusted returns (compared to the US) and we expect managers that have focused on credit will be rewarded in the challenging economic environment.

Investors can access exposure to private credit through the Perpetual Pure Credit Alpha Fund which can allocate a significant proportion of their FUM to private credit.

Find out more about Perpetual’s Credit and Fixed Income Funds.